27+ claiming mortgage interest

You may still be able to. Web You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately.

27 Sample Quit Claim Deed Forms In Pdf Ms Word

The Trusted Lender of 300000 Veterans and Military Families.

. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. HELOCs are no longer eligible for the. The Department for Work and Pensions confirmed in December that.

So if each person paid 50 of the mortgage each person is only eligible. Web An equitable owner can deduct interest paid on a mortgage even if they are not directly liable for the debt. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

Further mortgage payments and taxes. Web What counts as mortgage interest. Web First to claim the mortgage interest deduction taxpayers must itemize when filing federal tax returns rather than taking the standard deduction.

Apply See If Youre Eligible for a Home Loan Backed by the US. Ad Are you eligible for low down payment. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web For example if you rent out the property for a total of two months in the year you can deduct 212 167 of your mortgage interest. Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to. Web Heres how to claim the mortgage interest deduction.

According to the Internal Revenue Service IRS US. Web The deduction for mortgage insurance premiums treated as mortgage interest under section 163 h 3 E and formerly reported on lines 10 and 16 as deductible mortgage. Web The answer is that you can only claim the deduction for the interest you actually paid.

Web Most homeowners can deduct all of their mortgage interest. Mortgage interest is claimed on Schedule A Line 8. Web 1 day agoYou can however in the US.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Your mortgage lender is required to provide a 1098. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years.

Homeowners can deduct home mortgage interest on the first 750000 375000. If you rent it out for a total of six. The terms of the loan are the same as for other 20-year loans offered in your area.

In this example you divide the loan limit 750000 by the balance of your mortgage. Find all FHA loan requirements here. 1 2018 youre allowed to deduct the interest paid on up to 1 million of home acquisition debt plus 100000 of home.

Web Mortgage Interest. So if each person paid 50 of the mortgage each person is only eligible. Households claiming the home mortgage interest deduction declined.

Web Commissione r 138 TC. Web If you took out your mortgage before Jan. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

How Much Interest Can You Save By Increasing Your Mortgage Payment. 8 2012 the Tax Court dealt a blow to wealthy unmarried couples and same-sex couples who have not married under state law holding. Web Thousands of households have just days left to claim 300 free cash Credit.

You paid 4800 in. Web The answer is that you can only claim the deduction for the interest you actually paid. Mortgage interest is charged for both primary and secondary loans home.

The interest charged on a loan used to purchase a residence. Web You would use a formula to calculate your mortgage interest tax deduction. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Investing In Bc

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1912 Session Ii Education Thirty Fifth Annual Report Of The

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Mortgage Interest Deduction Bankrate

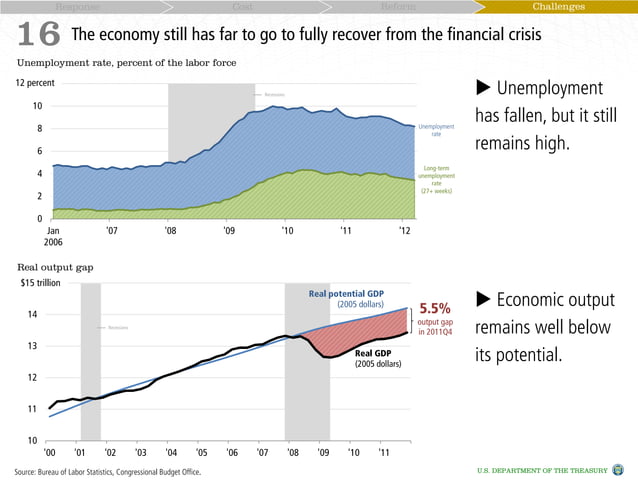

Response Cost Reform Challenges 16

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1912 Session Ii Education Thirty Fifth Annual Report Of The

23 29 May 2017 By Costa Blanca People Issuu

25 Letter Of Explanation Templates For Mortgage And Derogatory Credit Word Best Collections

Paying Down A 30 Year Mortgage Faster Vs 15 Year Mortgage My Money Blog

5 Year Fixed Mortgage Rates And Loan Programs

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

What Is The Mortgage Interest Deduction The Motley Fool

Mortgage Interest Tax Relief Changes Explained Taxscouts

Mountain Times Volume 48 Number 48 Nov 27 Dec 3 2019